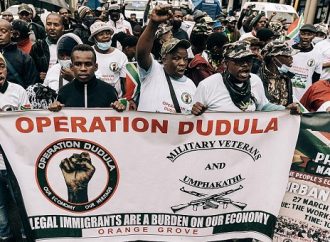

The Federal Inland Revenue Service (FIRS) insists it will continue to collect Value Added Tax (VAT) from businesses operating in the country. This comes despite the recent High Court judgment ruling against the agency in favour of Lagos and Rivers State. FIRS insist on collecting Value Added Tax. This was detailed in a letter sent

The Federal Inland Revenue Service (FIRS) insists it will continue to collect Value Added Tax (VAT) from businesses operating in the country. This comes despite the recent High Court judgment ruling against the agency in favour of Lagos and Rivers State.

FIRS insist on collecting Value Added Tax.

This was detailed in a letter sent by Muhammed Nami, executive chairman of FIRS, addressed to Moyosore Onigbanjo, the attorney general and commissioner for justice in Lagos state.

The Lagos state government had directed the FIRS to stop issuing demand notices for payment of VAT in the state and to render accounts, within seven days, of all sums collected as VAT in the current accounting circle in the state.

The state government premised its demands on the decision of the federal high court in Port Harcourt, Rivers state. The state governor, Nyesom Wike yesterday 6th of September 2021 ordered the Rivers State Revenue Service (RSRS) to fully implement the State Value-Added Tax Law 2021 which he assented to recently.

This follows the judgment against the Federal Inland Revenue Service (FIRS) to stop the state government from collecting VAT. The former having filed an application at a Federal High Court in Port Harcourt, the state capital.

Leave a Comment

Your email address will not be published. Required fields are marked with *